MONTHLY NEWS

December 30, 2025

Dec. 30, 2025 Federal Tax The IRS released the optional standard mileage rates for 2026. Most taxpayers may use these rates to compute deductible costs of […]

December 24, 2025

Dec. 24, 2025 Federal Tax The IRS issued frequently asked questions (FAQs) addressing updates to the Premium Tax Credit. The FAQs clarified changes to repayment rules, […]

October 29, 2025

Oct. 27, 2025 Federal Tax The Internal Revenue Service Math and Taxpayer Help Act has advanced to the White House after passage in the Senate. […]

September 4, 2025

John Zink, CPA, MBA has recently been promoted to supervisor at the public accounting firm of Woolston, Jensen & McNamara, Red Bank, NJ. John has spent […]

June 16, 2025

Ryan studied accounting and business at SUNY New Paltz, where he graduated with a Bachelor of Science degree. His previous experience interning at Churchin Group paved […]

June 12, 2025

Ben is an upcoming graduate of the University of Georgia, pursuing a Bachelor of Business Administration degree. His love for traveling sparked his interest in understanding […]

May 22, 2025

Shore Builders Association of Central New Jersey, Inc., held their annual marketing awards “FAME” at Southgate Manor, Freehold NJ on Thursday May 8, 2025. WJM (a […]

March 3, 2025

Businesses required to comply with the Beneficial Ownership Information (BOI) reporting requirements just got a temporary reprieve. The Financial Crimes Enforcement Network (FinCEN) has announced an […]

January 27, 2025

According to an alert posted on FinCEN’s beneficial ownership information (BOI) reporting webpage, BOI reporting is still voluntary for now despite the U.S. Supreme Court’s stay […]

January 22, 2025

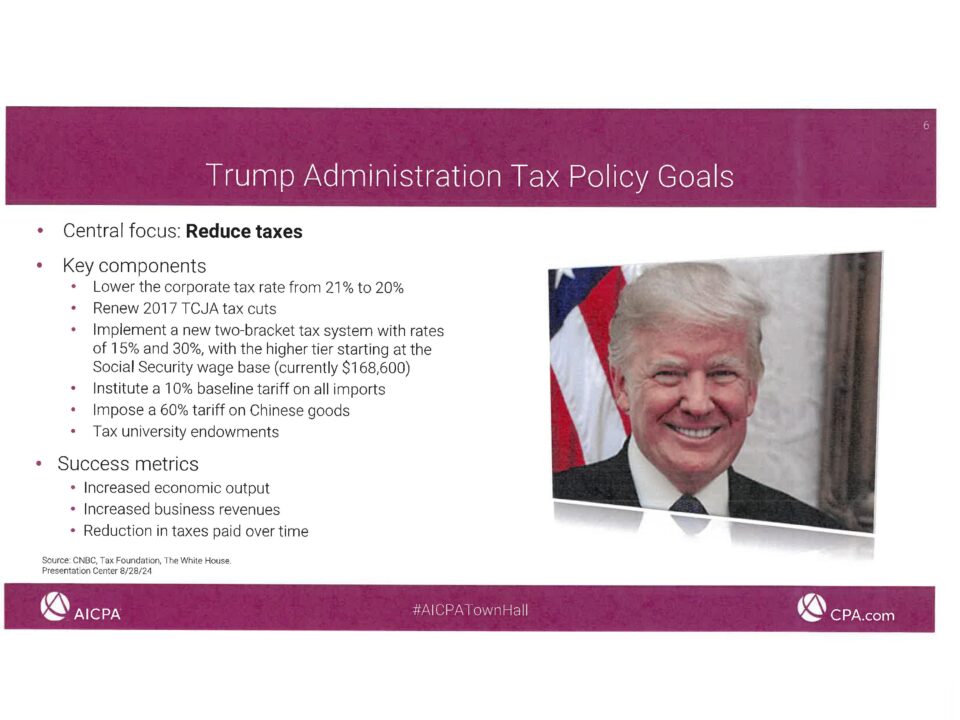

Federal Tax President Donald Trump targeted federal hiring, including specific rules for the Internal Revenue Service, and the United States’ participation in the global tax framework […]